Understanding Amortization Schedules and Calculations

May 17, 2024 By Susan Kelly

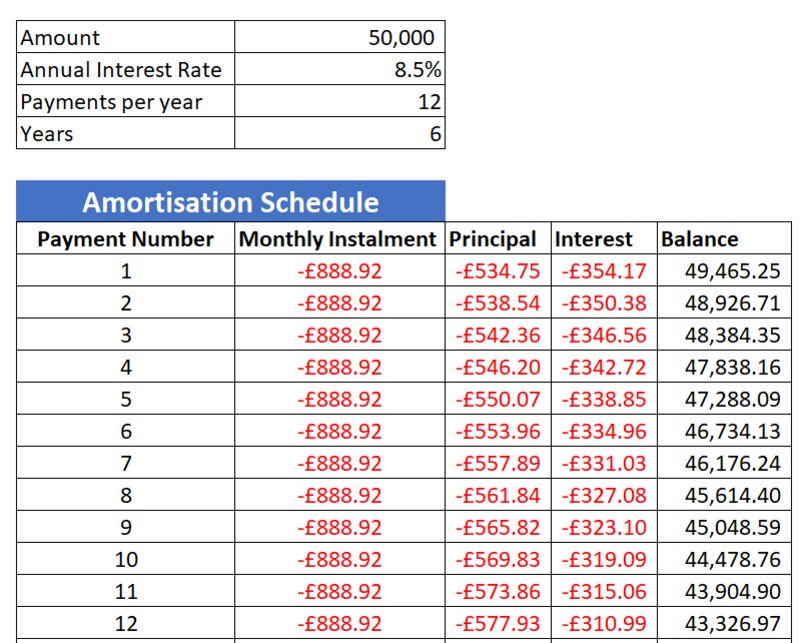

An amortization schedule is a table that provides detailed information about periodic loan payments, including the amount for interest and principal. It is very important to know how to calculate it for effective financial management. This article will explore what an amortization schedule means, why they are significant, how to compute them, and where they can be employed practically.

The Basics of Amortization Schedules

The amortization schedule, a key instrument in money planning, provides a detailed view of loan payments over time. It not only shows how much is paid but also the decreasing principal balance and rising equity. This clarity helps borrowers to anticipate their future financial responsibilities and plan for them.

Additionally, a repayment plan is not just a list of payments. It can be viewed as a guide to becoming free from debt. When someone keeps track of their repayment plan, they might notice chances to pay back faster. This could mean less interest paid and a shorter total time for the loan.

- Consider Extra Payments: Making additional payments towards the principal can significantly reduce the total interest paid over the life of the loan.

- Review Regularly: Regularly reviewing the amortization schedule allows borrowers to stay on track with their repayment goals and adjust strategies as needed.

Calculation Methodology

The idea of amortization might be complex to understand, but when it comes to calculating it, there are tools available that can make the process simpler. Spreadsheet software and online calculators have easy-to-use interfaces that only need basic information like loan amount, interest rate, and term for inputting data. These resources automate the complicated math formulas involved in determining schedules; borrowers can get precise schedules within seconds with these aids.

In addition, knowing the way to calculate helps borrowers evaluate if they can afford a loan or not before deciding. By playing around with different elements like interest rates and repayment time frames, people can understand better how each borrowing scenario may affect their financial situations in the future.

- Consider Loan Term: Shorter loan terms generally result in higher monthly payments but lower overall interest costs.

- Account for Extra Costs: Factor in additional expenses like insurance and taxes when calculating the total cost of borrowing.

Breaking Down Loan Payments

An amortization schedule is a piece of paper that presents how each payment for a loan is divided into two parts: interest and principal. The beginning payments have mostly interest, but this amount becomes smaller as the main balance reduces. This active interaction shows the idea behind amortization, displaying how borrowers gain more stake in their funded assets over time.

Additionally, comprehending how loan payments are divided can aid borrowers in recognizing chances to enhance their monetary approach. If people concentrate on diminishing the main balance, they may speed up equity gathering and potentially cut down the loan period.

- Early Payments Impact: Making extra payments early in the loan term can have a more substantial impact on interest savings.

- Consider Refinancing: Refinancing may be a viable option to secure more favorable loan terms and reduce overall interest costs.

Understanding Interest vs. Principal Payments

Differentiating between interest and principal payments is crucial for borrowers seeking to manage their debt effectively. Interest payments represent the cost of borrowing and are calculated based on the remaining principal balance and the loan's interest rate. In contrast, principal payments directly reduce the outstanding loan balance, gradually building equity in the financed asset.

In addition, the part of every payment that goes to interest compared to principal changes as time passes. At first, more money is assigned for repaying interest but this shifts slowly towards paying off the main amount as the balance decreases. This change highlights how important it is for amortization schedules to show how loan payments change over time.

- Impact of Interest Rates: Higher interest rates result in larger interest payments, increasing the total cost of borrowing.

- Consider Loan Types: Different loan structures, such as fixed-rate and adjustable-rate mortgages, may impact the distribution of interest and principal payments.

Managing Loan Repayment

Properly handling loan repayment is not only about making minimum payments; it also needs planning and predicting financial situations. Amortization schedules give people who borrow money a very useful understanding of their repayment process, helping them to check different payment plans.

Also, taking an active approach to managing loan payback can result in substantial money benefits like less interest expenses and quicker elimination of debt. When borrowers use the details offered by amortization schedules, they can make educated choices about how to pay back their loans efficiently to reach their financial targets earlier.

- Emergency Fund Consideration: Maintaining an emergency fund can provide a safety net during unexpected financial challenges, preventing default on loan obligations.

- Automate Payments: Setting up automatic payments ensures timely and consistent contributions towards loan repayment, minimizing the risk of missed payments.

Practical Applications

Amortization schedules have many uses and they are helpful for different financial products and situations. They make sense of complex numbers, which is beneficial for borrowers from diverse backgrounds. It does not matter if you are getting a mortgage, auto loan, or personal/business loan - all people can use these schedules to understand their repayment plans clearly and easily.

In addition, knowing about the use of amortization schedules helps people who borrow money to handle the difficulties in borrowing with assurance. When borrowers include these schedules in their money planning steps, they can decide better, manage payback methods well and finally reach stability and freedom in finance.

- Consider Prepayment Penalties: Some loans may impose penalties for early repayment, impacting the feasibility of accelerated repayment strategies.

- Consult Financial Advisor: Seeking guidance from a financial advisor can provide personalized insights and recommendations tailored to individual financial circumstances.

Conclusion

To sum up, an amortization schedule is a very useful aid in comprehending and controlling loan payments. When you understand how to handle an amortization schedule, as well as the elements involved in its calculation, you are better equipped to manage your finances and make wise decisions about repaying loans. Whether it is for personal or business purposes, the knowledge gained from these insights can help borrowers navigate through the complexities of debt repayment with confidence and clarity.

What Exactly Are Tax Brackets? An Explainer for the Financially Curious

Discover how understanding tax brackets, effective tax strategies, and smart planning can significantly reduce your tax burden and enhance financial health.

Mar 22, 2024 Susan Kelly

Documents Which I Need To File My Taxes

After you have submitted your tax return, you will most likely not feel the need to maintain all of the information associated with it, including your W-2, 1099s, and other documents.

Dec 18, 2023 Triston Martin

All You Need to Know About Grace Periods for Borrowers

Find out what a grace period for borrowers is, how it works, and look at practical examples for comprehensive understanding.

May 15, 2024 Susan Kelly

College Savings Using Series I Bonds: A Guide

Series I bonds were much sought after a year ago. The current yearly rate of 6.89 percent provides investors with the steadiness of a U.S. government bond while also shielding them from inflation. Naturally, folks would wonder what all the fuss is about. As a result of the high yield, investors in the Series I bond may wonder if they may use it in place of a 529 plan to pay for college

Jan 30, 2024 Triston Martin

What You Should Know Before Choosing Actively Managed Funds or Passive Investing

A portfolio manager and perhaps other "active participant" must take an active role in active investing. Less active trading is characteristic of passive investment, which often entails purchasing index funds and perhaps other types of mutual funds. Active and passive investing has advantages, but passive investing has attracted more capital. Passive investments have often generated higher returns than their active counterparts. For the first time in quite some time, active investing has gained traction, especially in times of market turmoil.

Jan 01, 2024 Triston Martin

Insurance Trust (ILIT) Definition: Protecting Your Family's Future with Ease

Want to explore Insurance Trusts (ILITs)? Dive into this simplified guide to grasp the basics of ILITs, how they work, and why they're important for safeguarding your assets.

May 14, 2024 Triston Martin