What The 2022–2023 Child Tax Credit Is, What It Takes To Qualify, And How To Claim

Nov 10, 2023 By Triston Martin

One of the most critical government initiatives that help families financially and why don't i qualify for child care tax credit for 2022-2023. It provides a tax credit to families that qualify to help with the financial burden of having children. Parents and guardians who want to maximize their tax benefits should familiarize themselves with the Child Tax Credit, its requirements, and the process for claiming it. Learn about the Child Tax Credit for 2022-2023, any updates, who qualifies, and how to file a claim in this comprehensive guide. This manual will help taxpayers claim the Child Tax Credit for their eligible children and avoid penalties.

What Is The Child Tax Credit?

How do you qualify for child care tax credit? The federal government offers a tax credit called the Child Tax Credit to aid families with the expenses of raising children. Its purpose is to minimize or eliminate the tax burden for qualified people. Taxes owing can be reduced by the amount claimed due to the credit for each eligible kid. The primary goal of the Child Tax Credit is to help families with children by reducing their tax liability.

Modifications To The Child Tax Credit For 2022-23

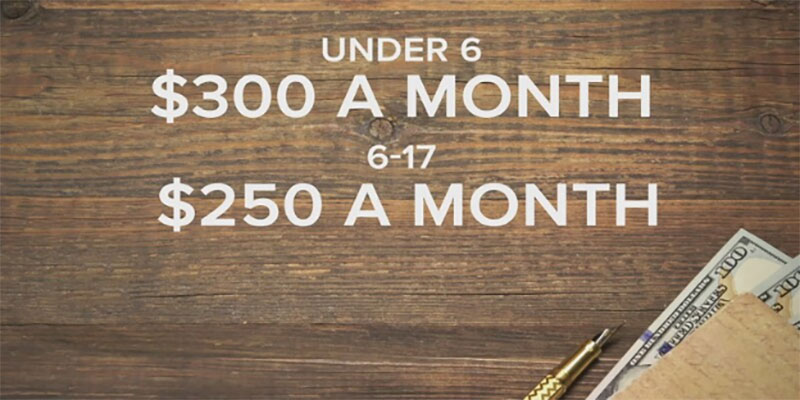

2022-2023, the government made significant adjustments to the child tax credit. The credit was increased in size and made available to a broader range of families due to the American Recovery and Reinvestment Act. When do you not qualify for child care tax credit? The credit per eligible child aged 6–17 increased from $2,000 to $3,000, while the credit for children under the age of 6 increased from $3,600 to $4,800. The distinction is now fully refundable, meaning taxpayers can get the whole amount even if it's more than their tax bill. These adjustments are intended to help families financially and reduce the burdens on parents and guardians.

Conditions For Receiving The Child Tax Credit

Taxpayers must meet specific criteria to qualify for the Child Tax Credit. First, as of the conclusion of the tax year, the child cannot be older than 17 years old. The child must be a citizen, national, or lawful permanent resident of the United States. Furthermore, the taxpayer must be the child's parent, grandparent, or legal guardian. A valid Social Security number is required for both the child and the taxpayer. There are also income caps, with the credit disappearing entirely for those with the highest incomes. Successfully claiming the Child Tax Credit requires that you meet these criteria.

How To Apply For The Child Tax Credit

Taxpayers should follow these procedures to claim the Child Tax Credit successfully. Check the qualifications to see if you are qualified to apply. Then, you'll need to identify and submit data for every eligible kid correctly. This includes the kid's name, age, and Social Security number. Determine your credit by dividing your income by the number of qualifying children. When filing your taxes, use the correct tax form, such as Form 1040 or 1040-SR. Ensure the credit amount is entered in the appropriate part of the form. For future reference and any auditing, keep all pertinent documents, including supporting records and forms.

Child Tax Credit Payments Made In Advance

Thanks to advance payments, eligible individuals can get a portion of their Child Tax Credit before they even file their tax return. These prepayments are part of the alterations for 2022-'23. The IRS requires taxpayers to submit information through a tax return or an online portal to get advance payments. During July through December, the advances are normally distributed monthly. Credits claimed on a tax return may be increased or decreased based on the taxpayer's choice to receive advance payments; therefore, taxpayers should carefully consider their eligibility and preferences before making this decision.

Other Important Considerations

There are various other factors besides the Child Tax Credit itself. First, learn about other family tax benefits like the Earned Income Tax Credit that can help financially—knowing how the Child Tax Credit interacts with other tax requirements, particularly the Alternative Minimum Tax. Who gets the credit may alter depending on marital status or child custody agreements. The importance of correct claiming must be balanced. Finally, it is necessary to precisely follow the requirements and obtain professional guidance, as erroneous claims or fraud can lead to penalties and legal implications.

Conclusion

Finally, the Child Tax Credit for 2022-2023 is a great way to help your family financially. Taxpayers can get the most out of the credit and reduce their tax liability by familiarising themselves with its rationale, prerequisites, and application procedure. It is crucial to correctly determine which children are eligible, how much credit to claim, and how to file for it. It is also essential to be aware of potential implications and fraud concerns and keep up-to-date on advance payment information. Families can benefit from this crucial financial aid program by claiming the Child Tax Credit and applying for other forms of support as necessary.

Cabela's CLUB Mastercard

Apart from getting points for Cabela's as well as Bass Pro Shops purchases, cardholders enjoy special benefits and discounts.

Nov 07, 2023 Triston Martin

What makes a city a financial center?

Cities with high concentrations of business, trade, real estate, and banking frequently develop into major international financial centers. Examples worldwide include London, New York City, Hong Kong, Singapore, San Franciso, and Tokyo.

Oct 09, 2023 Triston Martin

What You Should Know Before Choosing Actively Managed Funds or Passive Investing

A portfolio manager and perhaps other "active participant" must take an active role in active investing. Less active trading is characteristic of passive investment, which often entails purchasing index funds and perhaps other types of mutual funds. Active and passive investing has advantages, but passive investing has attracted more capital. Passive investments have often generated higher returns than their active counterparts. For the first time in quite some time, active investing has gained traction, especially in times of market turmoil.

Jan 01, 2024 Triston Martin

Understanding Marketing Strategy and Its Importance

Learn about a marketing strategy, how it operates, and the best way to put it into action for your business's success.

May 19, 2024 Triston Martin

Do You Need Pekin Life Insurance? Considerations and Uses

Pekin Life Insurance offers substantial coverage and riders for enhanced security. Their one disadvantage is that there are no online quotations on Pekininsurance.com.

May 10, 2024 Triston Martin

Best Credit Cards For Shopping On Amazon

Are you an avid shopper on Amazon? Find out which credit card can offer the most rewards, deals, discounts and purchasing power without paying an annual fee. Learn more now!

Dec 25, 2023 Triston Martin